How to start a company from scratch

Establishing and leading a startup is hard, but it is also an opportunity to do something creative, fun and unique.

The following is a condensed version of a Masterclass I recently presented for the International Mentoring Foundation for the Advancement of Higher Education (IMFAHE). The video of the full class is available here.

As regular readers may remember, I’m an academic turned serial biotech entrepreneur. I stepped back from active engagement in my first company, Stellular Bio, nearly five years ago to launch my second, STRM.BIO, where I also served as founding CEO. I’ve learned a few things along the way about establishing and leading startups through company formation, discovery, pre/clinical development and raising funding. And so I’m going to outline the planning process that has worked well for me and that I think represents a good general model for other entrepreneurs below:

One of the hardest lessons I’ve learned is that a company is not what I originally thought it was. With my first company, I thought I was building a mausoleum: a single place where I could put all my ideas, my philosophies and my plans. Something that would survive the test of time. What I was actually building was a sandcastle. A company is less permanent than I thought; rather, it’s custom-built for a specific place and time. No company lasts forever, and while no one knows how long a company will last – one, 10, or 100+ years – each one does have an expiration date.

This transience is welcome; in fact it’s liberating, because it gives you the flexibility to do something fun, something creative, something that you’ll enjoy doing. Eventually, the water is going to come and wash it away. But what do you get to build in that time? That’s the exciting bit, and excitement is a critical part of the overall experience because entrepreneurship can be very stressful. A lot of work goes into building your first and all subsequent companies, but you should try to take a step back and enjoy the process because it’s an opportunity to do something creative, fun and unique.

Expect that it will take time

My first company started around my kitchen table with a few of my friends, some pizza and beer, and a blank piece of paper. We worked together to define what we wanted to build and how we could realistically build it, and then we started the long process of iterative refinement over about a year before we were ready to pitch to potential investors. This is a pretty typical timeframe. Each of the stages I’m going to lay out below can take a month or more, and you should plan to repeat each stage several times.

There’s some hard work ahead of you, but taking a rigorous approach now will pay off later as you begin to execute on your plan. Try to approach this work with a creative and flexible mindset, as this can help you find the fun in the process of building a detailed plan around an idea that excites you.

Lay out the challenges

Your first task is to lay out each individual step that you think will be involved in building your company. The actual steps will be unique to your venture, so all the figures I’ve included below are just examples. Start with your end goal — your final product — and work backwards. Include everything at this stage, even small or speculative items; the goal is to develop a comprehensive initial list of activities, arranged in some semblance of order that will help you refine the list later.

Identify your key deliverables

Don’t throw this first version of the list away; you added each item for a reason. However, you do need to refine it, so the next step is to make a copy of the list and start cutting anything that doesn’t directly drive the development of your final product. Order activities by dependencies (for example, don’t put major experiments requiring large quantities of your product before manufacturing scale-up) and account for relative duration to complete. At the end of this process, you’ll be left with a set of key deliverables that you’ll need to achieve to meet your end goal.

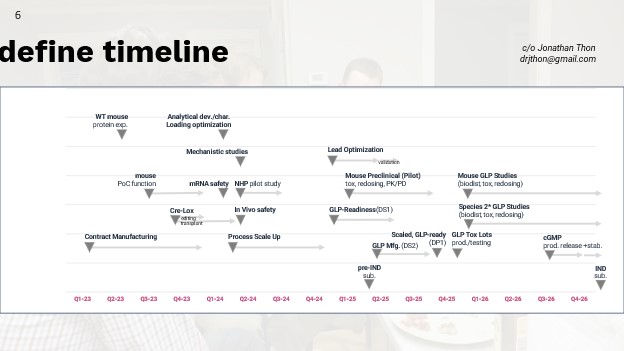

Define your timeline

Now that you know what you need to do, overlay the steps onto an initial timeline. Be realistic in your estimates of how long each step is likely to take. Optimistically outlining your best-case scenario might feel better than resigning yourself to the idea of this process taking longer than you initially anticipated, but it’s critical to have a realistic timeline in hand, as this document will inform your budget and many other downstream pieces of the overall plan.

Establish your milestones

Next, start binning groups of related key deliverables to create a smaller set of projects or programs that will serve as your company’s milestones. Each milestone should represent a set of activities that will collectively derisk your company’s value proposition. For example, a milestone could comprise a set of individual deliverables that collectively will provide proof of concept for a key aspect of your idea. Because reaching each milestone creates value and reduces the risk and cost involved in reaching the next milestone, you can also think of these milestones as value inflection points.

Identify your needs

You can now start estimating the resources you’re going to need to achieve each milestone: how many people, what kind of space, equipment, infrastructure, etc. Be as detailed as possible, as this will help you develop a more accurate budget.

Define your costs

Use your timeline and list of required resources for each milestone to estimate how much money you’re going to need at each stage of your development plan. Include salaries, facility and infrastructure costs, the material costs of all your R&D activities, contracts and outsourcing — everything you need to complete the set of activities included in each milestone.

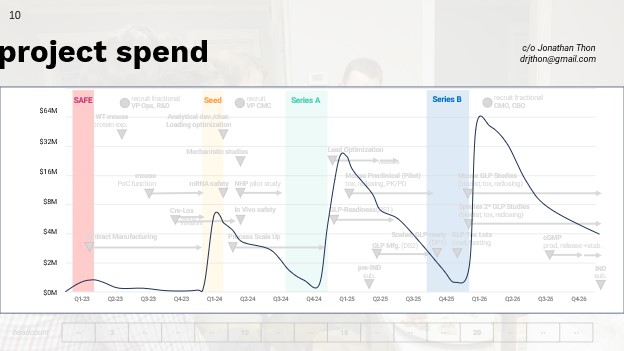

Project your spending

You can now start mapping your estimated costs at different stages of development onto named financing rounds, each with an estimated dollar amount. Knowing the standard terminology is useful here. It’s common to start with a loan of some kind, either from family and friends or from a bank or other external source, and then move on to formal investment in the company, starting with a Seed round, followed by Series A, Series B, Series C, and so on. Naming your rounds using the same conventions used by other companies will help investors understand the stage you’re at for each financing ask. Add your projected spend rate from your budget to visualize how you’ll gradually deplete the money raised in each round until you’re near zero, when you’ll need the next financing round to kick in. Make sure to build in the time it takes to raise each round, which is typically between six and nine months.

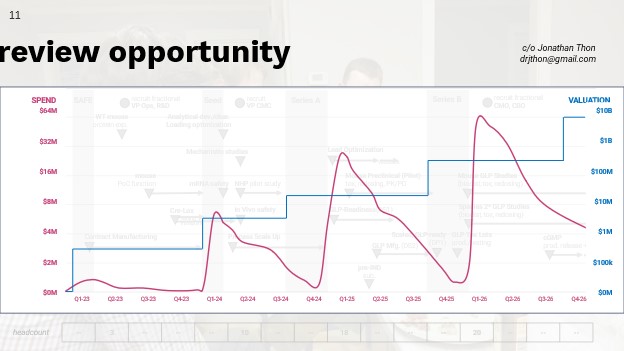

Review the investment opportunity

You now need to start thinking like an investor and estimating the value of your company at each stage of its development. Your company is unique, but there will be comparable companies out there that have tried solving the same problem (or a similar one) using a different approach. Start researching how the market has valued these “comps” at different stages in their own development. Look for press releases or other announcements about their financing rounds and other deals, investor commentary, whatever you can dig up. Use this information to graph your company’s projected value at different timepoints along your development plan. Because each milestone derisks your company and increases its value, the projected value should step up at the end of each milestone.

The purpose of this exercise is to inform a very real, honest and sometimes difficult conversation with yourself. Ask yourself if what you’re trying to build is going to return an increase in valuation that warrants the effort, timeand money it’s going to take to complete each step of the plan. Investors are going to want to see a two- to ten-fold increase in value over a development cycle, and ideally more; the investment needs to make sense for them, not just in terms of the magnitude of the return on investment but also the timeframe in which it will occur.

So check your value proposition at this point. Does it make sense? Would you put your own money into a company with these projections?

The answer might be “no”, or “not now” — and that’s okay. The work you’ve put in so far will have saved you a lot more work and stress down the line.

Iterate, iterate, iterate

If your answer to the “Does it make sense?” question is anywhere on the spectrum between an enthusiastic “yes!” and a “maybe?”, the next step is to iterate the entire process, bringing in trusted mentors and other experts to help you appraise and revise your plan.

Look again at your set of activities. Now that you’ve estimated how much they’re going to cost and have seen the kind of value that similar activities have created (or not) for comparable companies, maybe some of them can be cut. Reevaluate your timeline; could you work on some of your milestones in parallel rather than sequentially, and how would that affect your timeline and budget versus value creation? Could changing the order of some of the milestones result in a more favorable value creation projection for one or more of your anticipated financing rounds? How would it affect your budget if you outsourced some of the planned work to keep your equipment and personnel costs down?

Finally, reassess your refined value projection with fresh eyes, and ask yourself the same question as before: does this plan, this company, make sense from an investor’s point of view?

Define your narrative

Once you’ve made the decision to proceed, you can begin thinking about building a narrative pitch around your initial target stage of development. Your pitch deck is going to include, across multiple slides, the information I’ve summarized in a single image below. You’re going to use these slides to lead investors through the narrative of what you’re trying to build, what stage of development you’ve reached, what individual steps you’re going to take to get to the next stages, what successful completion of each stage means in terms of valuing and de-risking the opportunity, how much it’s going to cost to get you through that development, what you believe this step value or step valuation of the idea or the company will be after completion of that initial phase of development and what that means in the longer view as you build toward your end goal.

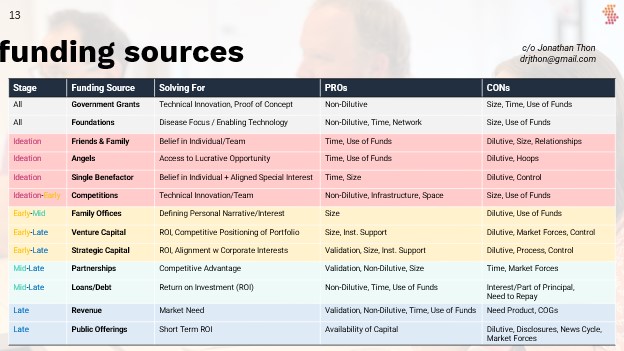

Funding sources

Once you have a plan and a narrative, it’s time to start thinking about how to finance your company. There are many potential sources of funding out there, all looking for different things in return for their money. Some non-dilutive funding sources, such as government grants and foundations, are solving for things like technical innovation or a disease focus and can be accessed by companies at any stage of development. Other funding sources are more suitable for specific stages. For example, friends and family and single benefactor funding are often motivated by a belief in a specific person or idea and are a good fit for earlier financing rounds, whereas venture capital and family offices are generally solving for return on investment and are more likely to come in later, once there’s already been some proof of concept and value creation.

Of course, the motivations and the pros and cons in the figure are generalities; each funder is unique, so it’s important to get to know the people investing in your field so that you can find the right match for you. Remember that the right match often changes as your company matures, so it’s normal to work with different investors during different financing rounds. It’s also common to combine a mix of different investor types in a single round, in what’s called a syndicate.

The important take-away message here is to be flexible and creative; the funding source you choose for your ideation or seed round doesn’t have to lock you into the same investor or investor type for the entire tenure of your company.

What’s next?

Of course, there are other things you’ll need to think about before you launch your company, including building the right team, what kind of ownership dilution you can expect, and so on. However, putting extensive work into defining your milestones and estimating your timeline, financing needs, and value creation will give you the core of a detailed and realistic development plan that will form the basis of your pitch as you start to engage with potential investors. Combining your passion for your idea with this rigorous foundational work will give investors not only the enthusiasm but also the confidence they need to put their money behind you and help you achieve your shared goals together.

Good luck!

Featured Jobs

- Veterinary Medicine - Faculty Position (Large Animal Internal Medicine) University of Saskatchewan

- Canada Excellence Research Chair in Computational Social Science, AI, and Democracy (Associate or Full Professor)McGill University

- Psychology - Assistant Professor (Speech-Language Pathology)University of Victoria

- Business – Lecturer or Assistant Professor, 2-year term (Strategic Management) McMaster University

- Education - (2) Assistant or Associate Professors, Teaching Scholars (Educational Leadership)Western University

Post a comment

University Affairs moderates all comments according to the following guidelines. If approved, comments generally appear within one business day. We may republish particularly insightful remarks in our print edition or elsewhere.